Beware of the Retirement Risk Zone

by Steve Lewit

A Mistake Here Could Upend Your Retirement Dreams

I think you would agree that life doesn’t always work out as we plan. When the unplanned comes our way, we set out to fix whatever it is—to make things right. Sometimes we can get back on track quickly, but other times it may take months or even years.

A storm on your vacation, for example, may sideline your touring for a few hours but, after it passes, you are back on your way. Getting fired from your job, on the other hand, may take months to rectify—if you can find a new job at all. When things go wrong in the Retirement Risk Zone however, getting back on track may be impossible. Let’s see why.

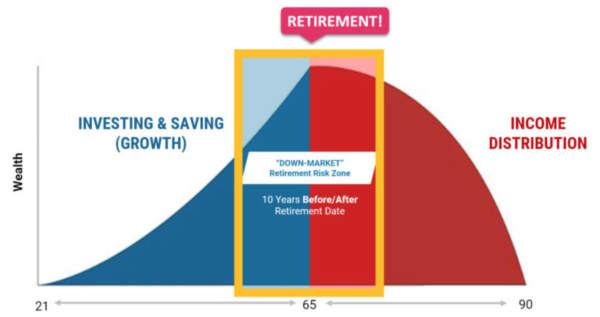

The retirement risk zone is the critical period leading into, and just after, retirement. We define it as the ten years before retirement and the ten years after retirement. Prior to entering the Risk Zone is the Growth (or Accumulation) Phase of your life. Once you retire, your thinking needs to shift from accumulating assets to Income Distribution, where your assets must work to provide income for you for the balance of your life.

If you suffer market losses in the Growth Phase (i.e. at the worst point in 2008 the S&P was down about 54%), you have time to wait to recoup those losses. Once you enter the Risk Zone, however, time is not on your side. You will either need those funds soon to produce income, or you have already begun withdrawing income from your assets. Either way, selling when the market is down because you need the money to live on leaves less money to make up the losses during recovery. The result—your assets deplete much faster than expected. This is called Sequence of Return Risk.

How Does Sequence of Return Risk Work?

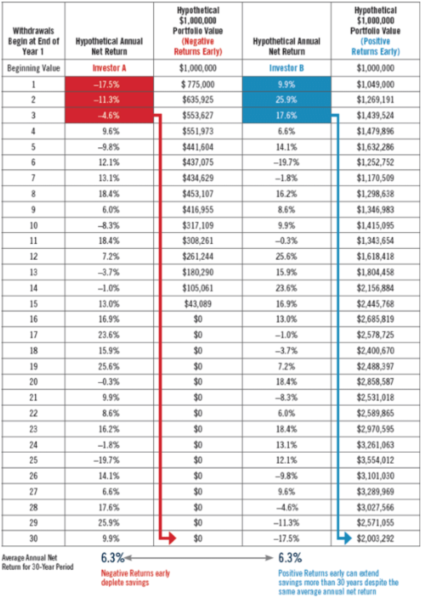

Meet Investor A and Investor B in this hypothetical example. Both portfolios have the same average return of 6.3% over the 30 years, but the outcomes couldn’t be more different because of the sequence of returns. Investor A’s negative returns early on, in the Retirement Risk Zone, deplete their savings after 15 years. Investor B’s positive returns in the Retirement Risk Zone have extended their savings beyond 30 years, despite the same average annual return.

Most folks focus on average returns, which are, of course, important. At the same time, however, most folks (and many advisors) fail to look at the sequence of those returns. Without addressing the possibility that losses may occur early in retirement, a significant impact on your ability to reach your retirement goals may come back to haunt you.

What to Do

1. One of the ways to survive the Retirement Risk Zone is to simply avoid the market altogether. While this may solve the Sequence of Returns problem, or satisfy a conservative investor, the reality is that guaranteed interest investments are not very attractive and cannot support most retirement income needs (few people have enough assets where a 2% – 3.5% return can support their income needs, especially when inflation is included in the calculation). So, guaranteed interest products probably won’t get the job done.

2. Make sure you know the upside and the downside of your market-based portfolio. When we ask folks what their goals are for their portfolio, they usually say something like, “We want to make the same as the S&P,” or “We want to make as much as possible.” When we ask if they know how much their portfolio could lose in a bad year, few can give a well-documented answer. To manage portfolio risk properly, especially in the Retirement Risk Zone, make sure you have a complete retirement income plan which identifies what growth you need (rather than what you want—most people are taking more risk than they need to) and what amount of loss you can sustain.

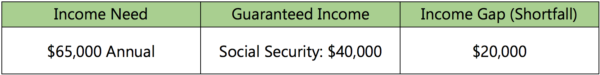

3. Another possible solution is to cushion, or even divorce, your income needs from your market portfolio. For example, first determine your Income Gap. This is the amount of income you require, less any income you are receiving in retirement. For example, let’s say your income need at retirement is $65,000 and you and your spouse will receive $40,000 in Social Security (if you had a pension you would add it to you guaranteed income). That means that your Income Gap, or shortfall, is $20,000.

If you withdraw this amount from your market-based assets in the Retirement Risk Zone, then Sequence of Returns Risk could come into play. If, however, you guaranteed this income by purchasing an annuity (there are many options) then all your retirement income is now guaranteed and Sequence of Return Risk is eliminated, allowing you to cruise through the Retirement Risk Zone without worry.

4. Let’s say you don’t like annuities, is there another possible solution? Yes, there is. Instead of just pulling your income needs out of your market money as most people do, you can set up a Dynamic Income Bucket Strategy. Here, you break your coming years into, let’s say, five-year periods. Your job at the beginning of each five-year period is to make sure that you have liquid funds that will fund your income gap for that period (adjusted for inflation).

So, for example, let’s say your total income gap for the first five-year period is $100,000. It would make sense to have this very liquid, perhaps in cash in a savings account. Now, if the market declines during that first five years Sequence of Returns has not been impacted. Likewise, for the next five years. Let’s say you need $120,000 dollars liquid to cover this time period. Well, you could invest about $98,000 today in a 5-year product that guarantees 4% per year (now available in a MYGA – Multi-Year Guaranteed Annuity), when you need your money liquid, it is there for you.

By planning to be liquid at the beginning of each 5-year period using guaranteed or low risk products, you will always have your income available and market downturns, while impacting what you might leave to your heirs, will not impact the success of your retirement income plan.

The Bottom Line

It is my experience that retirees or those who are considering retirement need to be very careful about taking too much risk in their portfolios when they are drawing income. The combination of market losses and income withdrawals can dramatically increase the risk of running out of money. There are steps you can take to eliminate or minimize this risk.

I suggest that you look behind the sizzle and hype of fancy marketing pieces, promises, and portfolio growth rates and focus on developing a sound retirement income plan that creates guardrails that serve to minimize your investment risk and maximize your income stability. Remember, there is no such thing as the perfect investment. Every investment has good and bad points. So, research wisely and plan well before you buy. Most of all, don’t let the Retirement Risk Zone sink your retirement dreams.