The Healthy Money Mindset

by Steve Lewit

Money—we strive to earn it, save it, and then, when we retire, make sure it lasts the rest of our lives. As we age, we develop specific beliefs about money—beliefs we’ve inherited from parents, friends, TV, radio, books, and advertising. History teaches us that many of those beliefs have not served us well. Whether you have a lot or a little of it, it is the cause of over 50% of divorces and one of the main sources of arguments between partners and couples, parents and children, employers and employees. In retirement, no matter the level of wealth, running out of money is the most common source of worry and stress. Need it be this way? Absolutely not, but only if you have a healthy money mindset.

Where Does Money Fit In?

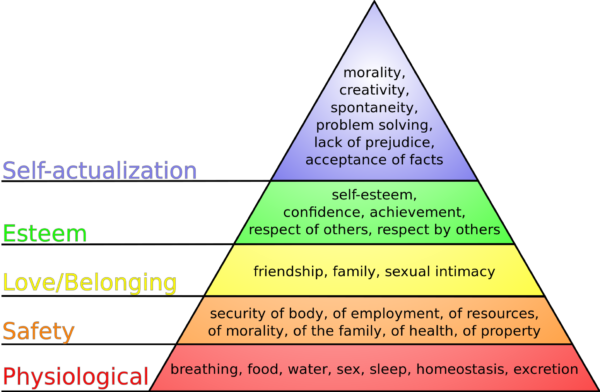

Let’s begin by understanding where money fits into our lives from a more philosophical perspective. Perhaps you remember this chart called Maslow’s Hierarchy of Needs.

Maslow’s Hierarchy of Needs is a motivational theory in psychology comprising of a five-tier model of human needs, depicted here as hierarchical levels within a pyramid.

Needs lower down in the hierarchy must be satisfied before individuals can attend to needs higher up. One builds upon the other. If a lower level is weak, so too will be those levels above it. In a worst case scenario, for example, people living in the world without their basic physiological needs satisfied—such as food, water, and shelter—find it difficult, if not impossible to feel safe, develop feelings of love and belonging, confidence, self-esteem, and to grow morally and creatively. Money fits into the level of Safety. When employment and cash flow are satisfied, most people will feel more secure, confident, and safe about their future.

See Money as Fuel for Your Journey

Often, we are so focused on money in itself, we forget that it is just a tool—fuel to get us from point A to point B on our journey through life. The result of focusing on money just as money, is that we lose perspective of what we are trying to accomplish with our earnings, savings, and investments.

Many people tell me they want their money to grow as much as it can. But, they can’t tell me how much is enough or why they picked such a high rate of growth to aim for. That’s like pulling into the gas station and filling up with premium gas just because it sounds good, not because your car requires it. If you envision money as fuel for your journey, then it is imperative you know, before you invest, how long your journey will be (how long you will live), where you are going (your goals), how much it will cost (are you going to fly budget or first class). Then, when your plan is in place, you can choose the best investment, or the best fuel for you financial car.

Start From Where You Are, Never Look Back

Your money mindset has been brewing for a very long time. Over the years you’ve developed certain money beliefs, biases, and behaviors that were influenced by family history, teachers, friends, books, and the media. These create financial habits, some of which may work for or against you. Everyone makes mistakes in the past, but there’s nothing you can do about those. The only control you have is what you’re going to do now, in the present. If you’re blaming yourself about the past, feeling guilty, beating up on yourself, or telling yourself how stupid you’ve been, then your future will be shaped by those thoughts. If, however, you recognize your past, and aim to control the present, then your future will have much more potential, and a higher probability of financial success.

Have the Courage to Question What You Believe

Psychologists say that we fall in love with our beliefs. So much so, that they may blind us from taking advantage of other options that may serve us well. For example, you may believe that taking on debt is always a bad idea (except for your home), or that you should never buy an annuity, or that you can figure out how to time the market, buy low and sell high. But, let’s say the research says just the opposite—that debt could be good for you, that annuities have a place, that you can’t time the market consistently.

Will you let go of your beliefs and follow the research, or will you just go on doing what you believe is right? Beliefs about money are strong driving forces in your financial decision making. Do you have the courage to challenge what you believe and, perhaps, change one for another?

Face Your Biggest Money Fear

Most everyone has some fear about money. Sometimes that fear is well-founded, at other times it’s totally irrational. A well-founded fear right now is that there is a high probability that this long-running bull market will soon come to an end and you may suffer substantial losses in the next months. An irrational fear is my client who has over $2 Million invested, but will not spend more that $32,000 a year because she is afraid she will run out of money.

The number one fear among people thinking about retirement or in retirement, is the fear that their money will not last as long as they do. Whether your fear is rational or irrational is irrelevant. To you it is real, and it impacts your stress levels. We suggest you balance fear with logic and data, the basis for a good plan. If your logic and data are strong enough and your plan solid enough, fear has less of a hold on you, or might even disappear entirely. But, that can only happen, if you’re willing to admit and consider your fears, especially your biggest fears about money.

Create Daily Money Goals

Most people think of goals long-term. How much will I spend this year? How much will my money grow over the next ten years? Will my money last 30 years? Long-term goals are quite important. They set the framework of your financial plan. Commonly ignored—for the most part however—are short term goals. How much will I spend today? Where can I save money in the next few hours? What can I buy that’s on sale? Can I eat at home instead of eating out? Do I really need to buy this?

It all begins with being observant each moment of the day when it comes to your money. Think of it like driving your car on a long road trip. Your ultimate end goal may be to drive to California, but if you don’t stop at the next red light your trip could be a disaster. Long-term goals frame short-term goals and short-term goals make reaching your long-term goals more probable.

Create a Great Money Story

If you had to tell a story about your money life what would that story sound like and what would the central theme of your story be?

This is where you decide what the money story you want to live out is, as compared to the story you are living out today. Take a step back and see if you can hear the story going on in your head today about money. Perhaps you are saying to yourself that you can’t control impulse purchases, how easy it is to put things on your credit card, building up high interest debt. Maybe you are telling yourself that you are the kind of person who lets money slip between your fingers or, on the opposite side of the fence, the kind of person who is more than frugal, but living in fear that if you spend money you will feel guilty or selfish, or that your friends might think you’re a spendthrift. Some people tell me that they’re just not smart enough to handle their money well, but don’t trust enough to let someone else do it for them. We all have stories about our money to tell.

Now, suppose you took an hour and reconstructed your story as you would like it to be. Maybe it will feel like total fiction or an impossibility for you, but that doesn’t matter. What matters is that you begin to set up a new dynamic between you and your money, one that is more positive, more able to help you meet your goals. Once your story is written, then review it, hopefully daily, so that it becomes part of your thinking. If you do, remarkably, little by little, your attitude towards money and, more importantly, towards yourself will begin to change. One word of warning is that this is not a quick fix by any means. So, stick with it, give yourself time, appreciate that change at this level is usually slow, but when it happens, is effective and permanent.

Key Things to Remember

Your money mindset will drive your money decisions. If you’re willing to take a candid and close look at your current mindset you will determine what’s working for you and what’s not. If you have the courage to challenge your beliefs, your money life will change. If you can forgive yourself for what has happened in the past and look to the future, all kinds of doors will open for you. And, finally, if you recreate your money story, over time, it will change your life. There is no better time than to begin than right now. What’s the first thing that you will do? Now, go do it!