Understanding Mutual Funds: Financial Advisor Guidance

by Gabriel Lewit

When it comes to investing, there are endless options to select from depending on your tolerance for risk. If you’ve been going about it as a solo endeavor, now would be the time to work with financial professionals whose life work is dedicated to financial planning, investment selection, and wealth management. When trying to determine what to invest in and when, there are many moving pieces to consider these days.

If you’re looking for something that provides a balance of risk and reward, then mutual funds might be a wise option. Ask us about striking the right balance with strategic asset allocation at SGL Financial or use this guide to begin!

Because mutual funds involve a collection of securities that vary widely, you can leave it to our portfolio managers to handle the complexities of this ongoing task on your behalf. In this article we will help you understand:

- Different types of mutual funds

- What makes mutual funds unique

- Fees associated with mutual funds

- How mutual funds are taxed

What is a mutual fund?

A mutual fund is a type of investment that pools money from many investors to invest in securities like bonds, stocks, and money market funds. They are typically managed by professional investment managers. Each investor owns shares in the mutual fund, which gives them a proportional claim on assets.

Mutual funds are typically managed by professional investment managers actively or passively:

- Actively-managed mutual funds employ professional money managers to pick stocks that they think will perform well in order to maximize returns for their investors.

- Passive mutual funds track an index such as the S&P 500 and hold those stocks directly instead of trying to pick individual stocks themselves.

Mutual funds can be bought or sold during trading hours at prices known as net asset value per share (NAVPS). This price is calculated by multiplying the number of outstanding shares by NAVPS per share at market close each day.

What are the reasons to invest in a mutual fund?

- Investing in a mutual fund is a great way to highly-diversify your portfolio, which contain baskets of thousands of different stocks, bonds, and alternatives.

- During periods of market volatility the investments you hold are already broadly diversified.

- You can also invest in funds that focus on specific industries or sectors.

- In general, mutual funds can help you grow your wealth.

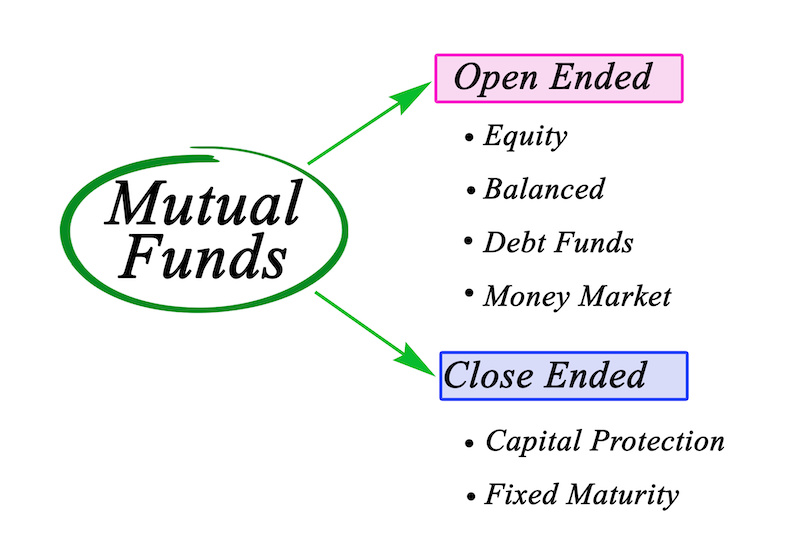

What’s the difference between an open-end and closed-end mutual fund?

In general, an open-end mutual fund is traded on a stock exchange. The number of outstanding shares can change over time as investors buy and sell shares.

A closed-end mutual fund is not traded on the stock exchange; instead, it has a fixed number of outstanding shares that cannot be changed by the fund management company. There is typically no initial public offering (IPO) for a closed-end mutual fund because it doesn’t have any new shares to issue.

The difference between open-end and closed-end funds may seem subtle at first glance, but there are some important distinctions worth knowing. Share your questions with a financial advisor in Buffalo Grove, IL, at SGL.

What are the different types of mutual funds?

Mutual funds can be classified by their investment objective, the type of fees they charge, and the kind of investor they are suitable for. In general, these are the different types of mutual funds to discuss with us:

- Money market funds

- Equity funds

- Fixed income funds

- Specialty funds

- Balanced funds

- Index funds

- Fund-of-funds

What makes mutual funds unique?

Mutual funds are not stocks. If you buy a stock, you own part of the company and its profits. You can also sell it at any time for cash.

Mutual funds are not bonds, which are loans that mature after a set number of years and pay interest to their owners until then.

Mutual funds are not exchange-traded funds (ETFs), either: ETFs trade on an exchange like stocks do; you can buy or sell them whenever you want, but they don’t have any physical holdings. Instead, they’re simply baskets of other assets that behave like a single asset group when trading on an exchange.

Mutual fund shares must be held until maturity or redeemed by selling them back to the fund itself; they’re not meant to be sold back into the market like individual stocks and bonds can be (and usually will be).

What are the fees associated with mutual funds?

There are four types of fees associated with mutual funds:

- The fees charged to the fund by its investment manager, who directs the portfolio and selects stocks and bonds.

- The fees charged to the fund by its distributor: the company that markets and sells mutual funds to investors.

- The fees charged to the fund by its administrator: the company that manages paperwork related to investing in a specific type of security like stocks or bonds, such as registering them with regulators so they’re considered “legal” investments.

- Custodial expenses associated with keeping track of where everything is in order for it all not being lost somewhere within this system.

Are mutual funds safe?

For U.S. investors, mutual funds are among the most popular options. Yes, they are a great way to invest, but you need to be careful; not all are created equal. It’s important to note that mutual funds come in many forms, and they’re ultimately only as good as the person who’s managing them.

Although they’re considered safer than most investments, even mutual funds can drop in value if the chosen stocks don’t perform well. So take precaution by speaking with a financial advisor in Buffalo Grove, IL, on the SGL team to protect your portfolio with strategic asset allocation. Here’s how to choose a good mutual fund that will help you reach your financial goals:

Look for low fees: All else being equal, higher fees mean lower returns on your investment. Make sure that any fund you’re considering has reasonable operating expenses.

Consider its performance history: Look for a track record of solid returns with minimal downside risk over time. A fund with this type of performance history is likely doing things right in terms of managing risk.

Note: Mutual funds are regulated by the U.S. Securities and Exchange Commission (SEC), which means they are subject to extensive financial reporting requirements and must be audited annually. Mutual funds aren’t FDIC insured, so if a fund were to go bankrupt, you wouldn’t be able to recover your money from the Federal Deposit Insurance Corporation like you would with a bank account or CD that is FDIC insured. While it’s possible for your mutual fund investments not to perform well in any given year, consider that over time the stock market has historically increased at an average annual rate of almost 10%.

Mutual funds aren’t government insured either; however, many firms offer separate insurance products for their customers’ securities holdings through private insurance companies or specialized subsidiaries within their offering these protections directly through them as part of their advisory services.

If you have any concerns about whether this protection applies specifically for you as an investor who holds one or more mutual funds through them (or another firm), consult a financial advisor at SGL before purchasing any securities on behalf of yourself or others under your care.

How are mutual funds taxed?

Taxes are a vital consideration with any investment and mutual funds are no exception to the rules: they are taxed as ordinary income. So when a mutual fund sells for a profit, you are required to pay taxes on the gain, even if only held for a short time.

So if you’re thinking that you can avoid capital gains tax by selling within a year of buying them, think again. Mutual funds are actually taxed at the same rate as individual stocks, which apply no matter if your fund is actively trading or not.

Remove the guesswork by investing in an experienced team of financial advisors and tax specialists in Buffalo Grove, IL, by selecting the right firm with the right credentials.

Understanding your options can help you decide what’s right for you. Get a second opinion with a financial advisor in Buffalo Grove, IL, at SGL Financial.

We hope that this article has given you a better understanding of what mutual funds are and how they work. If you’re interested in learning more about these investments and strategic asset allocation, we recommend reading at our complimentary eBook: Asset Allocation 101.

We’d love to hear from you and answer any questions or concerns you may have.